WALL STREET

by Barbara E. and John F. McMullen

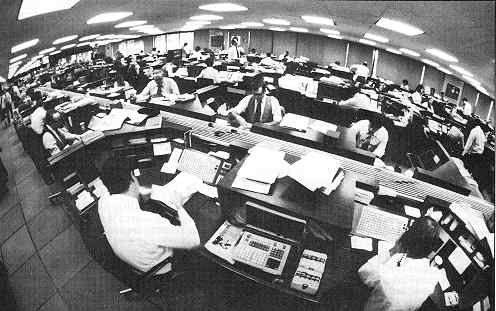

On Wall Street desktops, personal computers coexist with terminals connected to mainframe computers.

Barbara E. and John F. McMullen, founders of the personal computer consulting firm McMullen & McMullen, Inc., are the authors of Microcomputer Communications and contributing editors at PC and Computers & Electronics.

Personal computers conquered the financial community with blazing screens, despite the usual conservatism of its members. In 1977, while he was writing the Morgan Stanley Electronics Letter, Ben Rosen acquired an Apple II computer and proceeded to dazzle other employees with his new machine. We were two of those employees, and never in our combined thirty-five years of data processing had we seen anything like the color graphics he showed us, the voice input, or the weather maps of Kentucky.

Thanks to Ben Rosen and others like him, Wall Street foreshadowed the rest of the business world when it came to using micros. These electronics analysts came to realize, in the course of evaluating semiconductor and chip manufacturers, that the personal computers developed with this technology could in fact be extremely useful. First to use them were departments that traditionally received the least attention from centralized data processing: research, planning, budgeting and other areas not directly responsible for updating financial books and records. The common denominator was the changeable nature of these departments' demands, where a certain type of analysis can be required on one day, another on the next. This kind of "dynamic definition" is enough to unhinge the average data processing manager and precondition him to ignore all requests from these sectors.

Ben went on to write a program that performed basic number crunching on quarterly and annual corporate financial data to assist in company and industry analysis. When his use of the computer to perform tedious tasks with a minimum of effort became known within the industry, some of the braver souls went out and purchased their own micros and so initiated the first infestation of Wall Street by Apples, Commodores and Radio Shack TRS-80s. Unfortunately, they could do little with these machines unless they knew how to program them.

Then along came packaged software. With the advent of the VisiCalc electronic spreadsheet, people no longer had to struggle to write their own programs for investment research. Analysts watched other analysts using VisiCalc and ran out to buy it, only to find that the $100 VisiCalc program could be run on nothing but the Apple II and that a complete system required a $2,500 investment.

Almost concurrently, another program was introduced to the financial community. Computrac, developed by the Technical Analysis Group in New Orleans to examine commodity trading strategies, was greatly dissimilar from VisiCalc in application and presentation but shared two of the latter's important attributes: it provided service to those who had previously received little help from their data processing departments (in this case, the account executive specializing in commodities, the commodity trader or analyst) and it was made available only for the Apple II computer. This concentration of software on the Apple II led to the proliferation of one primary microcomputer and made it easier for firms interested in developing financial software to decide what machine to use.

Screen envy being what it was, microcomputers began appearing on desks throughout Wall Street and gave rise to a good deal of publicity concerning the use of these machines for investment analysis: Fortune ran an article on Ben Rosen's experiences; Dick Shaffer wrote periodically on the subject for The Wall Street Journal; Allerton Cushman, Morgan Stanley's insurance analyst, published Confessions of an Apple Byter, detailing his use of VisiCalc in financial analysis. Many Wall Streeters, particularly account executives, bought their micros because of competitive paranoia ("If Joe Blow uses a computer and is also a successful account executive, I better get one"); unfortunately, the systems purchased for this reason tended to wind up collecting dust as rather expensive bookends.

An interesting sidelight in this scenario is the manner in which the computers were acquired. Many account executives bought their own computers, then wrote them off for tax purposes. Computers for other areas were generally bought by the firms themselves and remained company property. In almost every case, the decision to buy was made by the person who would actually use the computer; the firm's data processing department was rarely involved in the decision-making process. Often department managers or vice-presidents were authorized to approve expenditures of up to $10,000 unless the item was related to computers, and in such situations the check for a computer installation would have the legend "Furniture" annotated on the stub; in other words, the firm was purchasing a $9,000 desk that just happened to have a funny-looking machine sitting on top of it at the time of delivery.

Then came full recognition. As personal computers increased at a heightened pace (soon there were hundreds of microcomputers within Merrill Lynch's branch office complex), media coverage of computer technology and applications went from virtual nonexistence to overkill. And with recognition came IBM. After an abysmal start in the field with expensive machines like the 5100, 5110 and 5120, IBM made a complete reversal and offered the IBM PC with some of the best-known software available, including VisiCalc. Data processing managers and purchasing agents, many of whom were unfamiliar or uncomfortable with names like Apple, Radio Shack and Commodore, could now do business with a firm they knew well. The IBM PC even accelerated the purchase of its competitors' products by convincing recalcitrant managers to fill long-shelved requests for personal computers.

And then came organization and institutionalization, as it always does in large businesses, along with the inevitable pressure to develop "corporate strategies" for the use of microcomputers. In some cases, as in the creation of support groups at Merrill Lynch and E. F. Hutton to aid users through advice, training and custom programming, this institutionalization proved to be beneficial. In others, the ensuing bureaucratic layers delayed the provision of microcomputer power to potential users while "cost justifications" and "system studies" were carried out.

The financial community had come full circle, reintroducing the frustration factor that led to the introduction of personal computers in the first place. Oh well, as Billy Pilgrim of Kurt Vonnegut's Slaughterhouse-Five might say, "And so it goes. . ."

HOW COMPUTERS CHANGED WALL STREET At the turn of the century, stack was still bought and sold on the curbside at Wall and Broad (left). Today, the floor of the American Stock Exchange could pass for a computer showroom(right). While the use of microcomputers in the Wall Street community is a well-known fact, little attention has been paid to the impact of large computer technology on the securities industry. The present levels of trading would be impossible were it not for the great proliferation of computer power throughout brokerage firms, clearing agencies and banks. In the early 1960s the average volume of shares traded daily on the New York Stock Exchange was slightly under five million and ten-million-share days were reason for celebration. As of this writing, average daily volume was sixty million and days of over a hundred million shares were commonplace. Some of the great improvement in capacity of the marketplace can be tied directly to the vastly increased speed of today's computers, but more important is the way brokerage firms and industry agencies changed their practices and procedures to adapt to the capabilities and power of the new technology. According to Robert M. Flanagan, former executive vice-president of Dean Witter Reynolds, the continual improvement in computer communications capability offers an accurate chart of the impact of computers upon the marketplace. • In the early 1960s ticker-tape machines were still being utilized to follow market activity. Orders were telephoned to the floor of the stock exchanges. • Rudimentary quotation devices began to appear from such firms as GT&E's subsidiary Ultronics, Bunker Ramo, Scantlin Electronics and Quotron. • Next, "store and forward" message systems (typified by Control Data's 8090 systems) came into use, allowing the brokerage firm's branch offices to enter orders on a teletype and send them through the system to the firm's broker on the floor of the appropriate stock exchange or trading facility. The reports of execution were then sent via computer back to the branch office and to the firm's operational staff, who prepared them for entry into the bookkeeping system. • The next step was the introduction of "order matching" systems (generally run on Control Data 3300 or large IBM 360 systems), which eliminated manual matching and preparation work, and allowed executions to flow automatically from the floor of the exchanges directly into automated bookkeeping systems. •More and more applications were integrated into this communications network. The quotation devices on account executive desks became input devices to the central computers of the firm, and the AE was given access to client information and research opinion as well as quotations. Parallel to this development of trade processing systems was the large computer's impact on the transfer of securities relating to trades. In the last twenty years, the industry has gone from the practice of hand delivery of securities for completing transactions to an automated system of updated records maintained by a central agency, the Depository Trust Company (DTC), to indicate ownership of securities. With many interim steps along the way, we now have the National Securities Clearing Corporation (of which Mr. Flanagan was a founder), which is responsible for the daily balancing of the majority of the securities transactions executed in the United States. There is also a direct interface with DTC to reflect change in ownership. Without this commitment to technological improvement, the securities industry could not be responsive to the demands of the marketplace. The volume increases in the mid-1960s occasionally forced the exchanges to close one day a week so that balancing could be performed. Accelerating the trend toward computerization was the "unbundling" of services that took final effect on "May Day" (May 1, 1975) and eliminated "fixed rates" of commissions charged by brokerage firms. This occurrence resulted in greater striving for operational efficiency within firms and caused them to look to data processing to eliminate labor-intensive work and provide greater service. Many of the mergers of Wall Street brokerage firms that followed were in large part motivated by the desire to share the expense of maintaining the computing power needed to remain competitive. Another related occurrence was the rise to prominence of firms such as Automatic Data Processing (ADP) and Brokerage Transaction Services, Inc. (BTSI), which provided shared data processing services to the brokerage community. J. AND B. McM. |

Return to Table of Contents | Previous Article | Next Article